Wealth Protector - PMS

Your Gateway to Financial Excellence

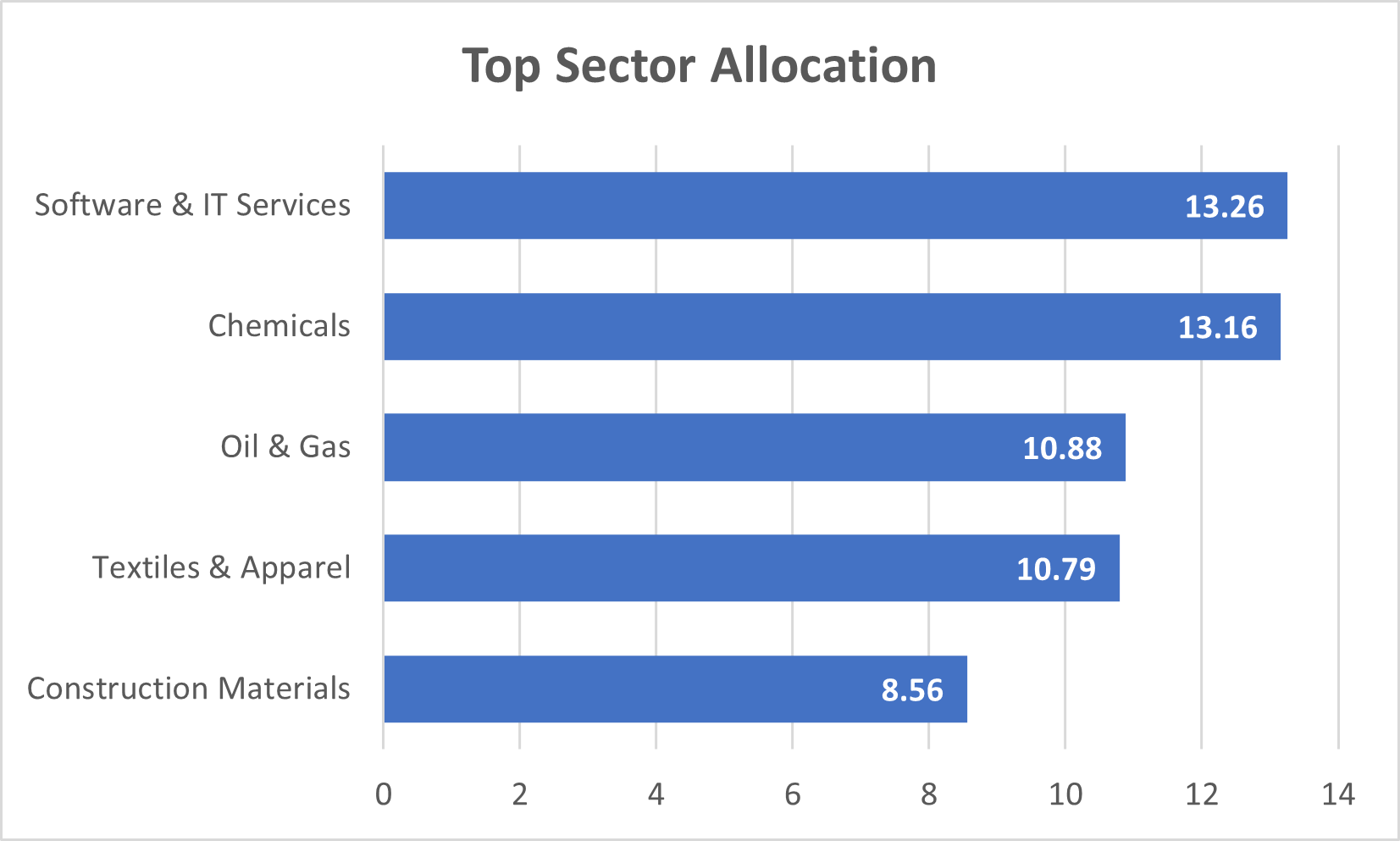

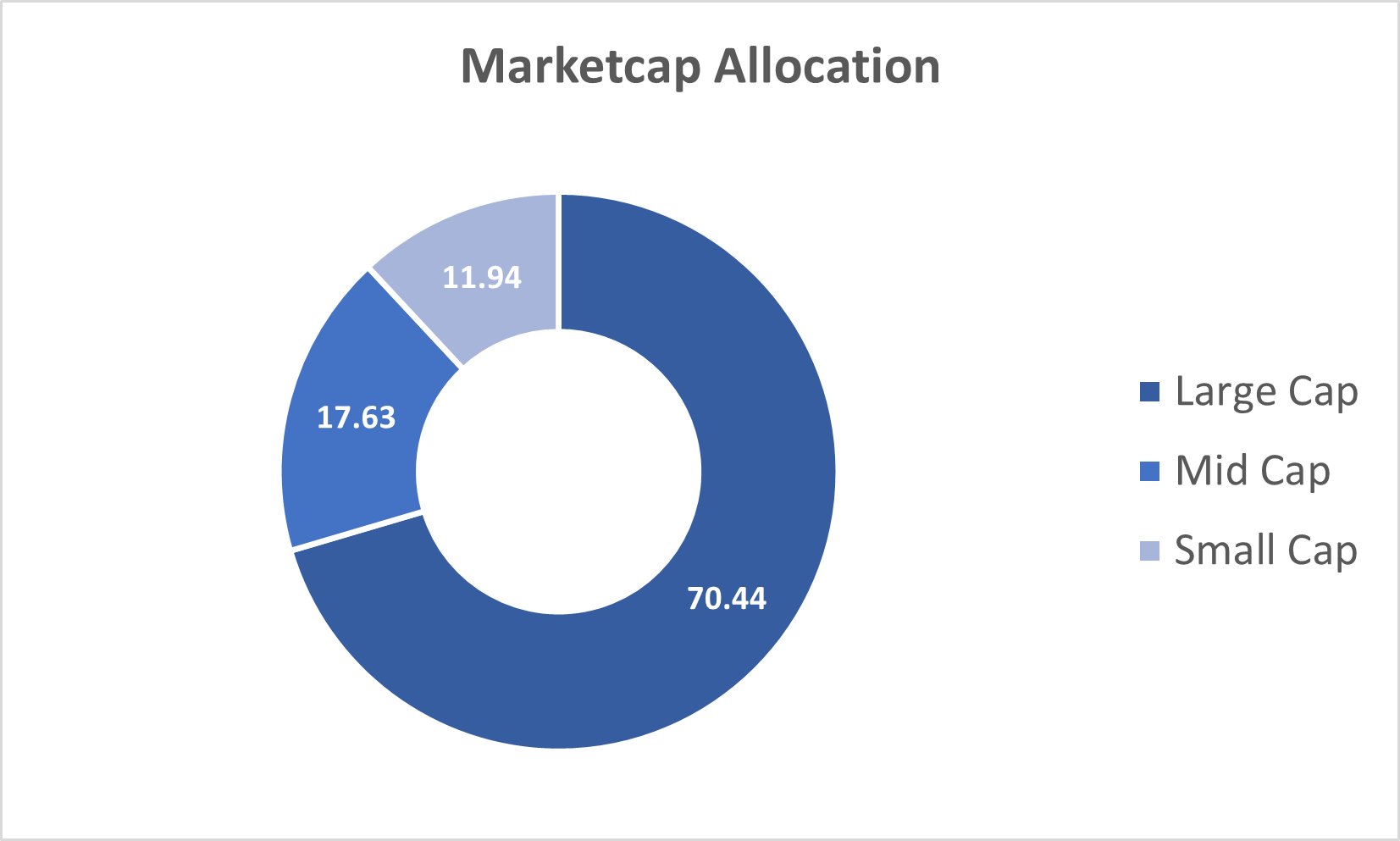

A meticulously crafted investment avenue designed to safeguard and enhance your wealth. Our primary goal is to generate dividends and foster capital appreciation for our esteemed investors by curating a diversified portfolio of equities across various sectors. At the heart of our strategy is the commitment to corporate governance, consistent growth patterns, and promising future prospects, all complemented by a high dividend yield.

Key Features of Wealth Protector:

Financial Excellence

Our fund focuses on stocks with a proven track record of financial excellence. These companies have demonstrated their ability to navigate market fluctuations and consistently deliver robust financial performance.

Dividend Distribution

We prioritize stocks that distribute a commendable portion of their earnings as dividends. This not only provides a steady income stream for investors but also serves as a testament to the financial health and stability of the companies in our portfolio.

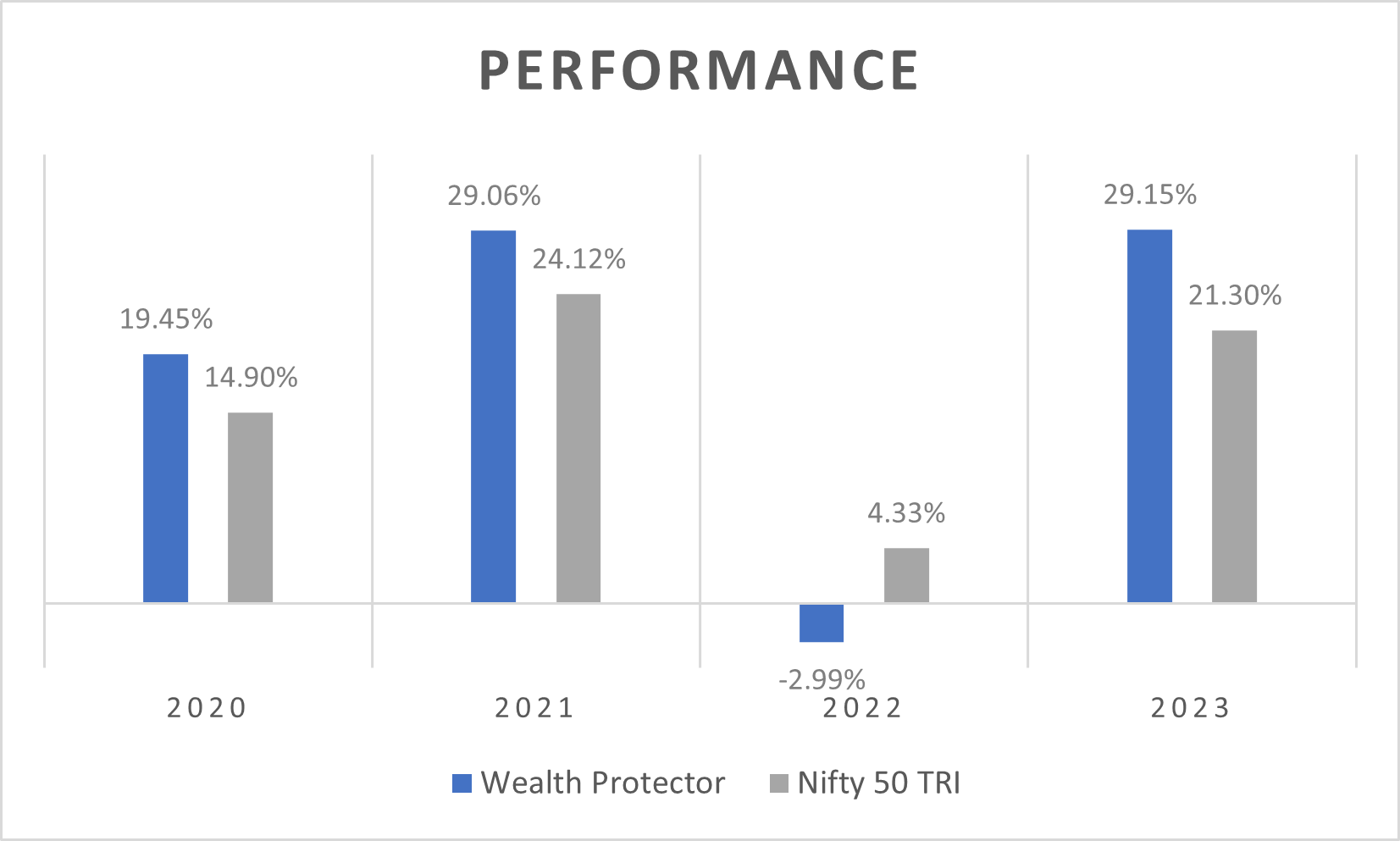

Lucrative Returns

By investing in Wealth Protector, you align yourself with a strategy that aims to deliver substantial gains in the medium to long term. Our investment horizon is set at a minimum of three years, allowing the fund to capitalize on market trends and deliver optimal returns to our investors.

Robust Growth Trajectory

While prioritizing long-term capital appreciation, Wealth Protector is dedicated to creating a robust growth trajectory for your investments. We identify and invest in assets with the potential for substantial growth, aligning your portfolio with the dynamics of a rapidly evolving market.

Risk Management

We understand the importance of safeguarding your capital. Our approach integrates robust risk management strategies to navigate various market scenarios. This ensures that your investments are resilient, delivering stable returns even in the face of market fluctuations.

Fund Information:

- Inception Date: 31st Dec 2019

- Category: Equity Diversified

- Type: Open Ended

- Benchmark: NIFTY 50 TRI

- Minimum Investment Amount: Rs 50 L

- Investment Horizon: 3 – 5 Years

- Fund Manager: Mr Manu Rishi Guptha