Wealth Maximizer - PMS

Unleash the Power of Strategic Wealth Growth

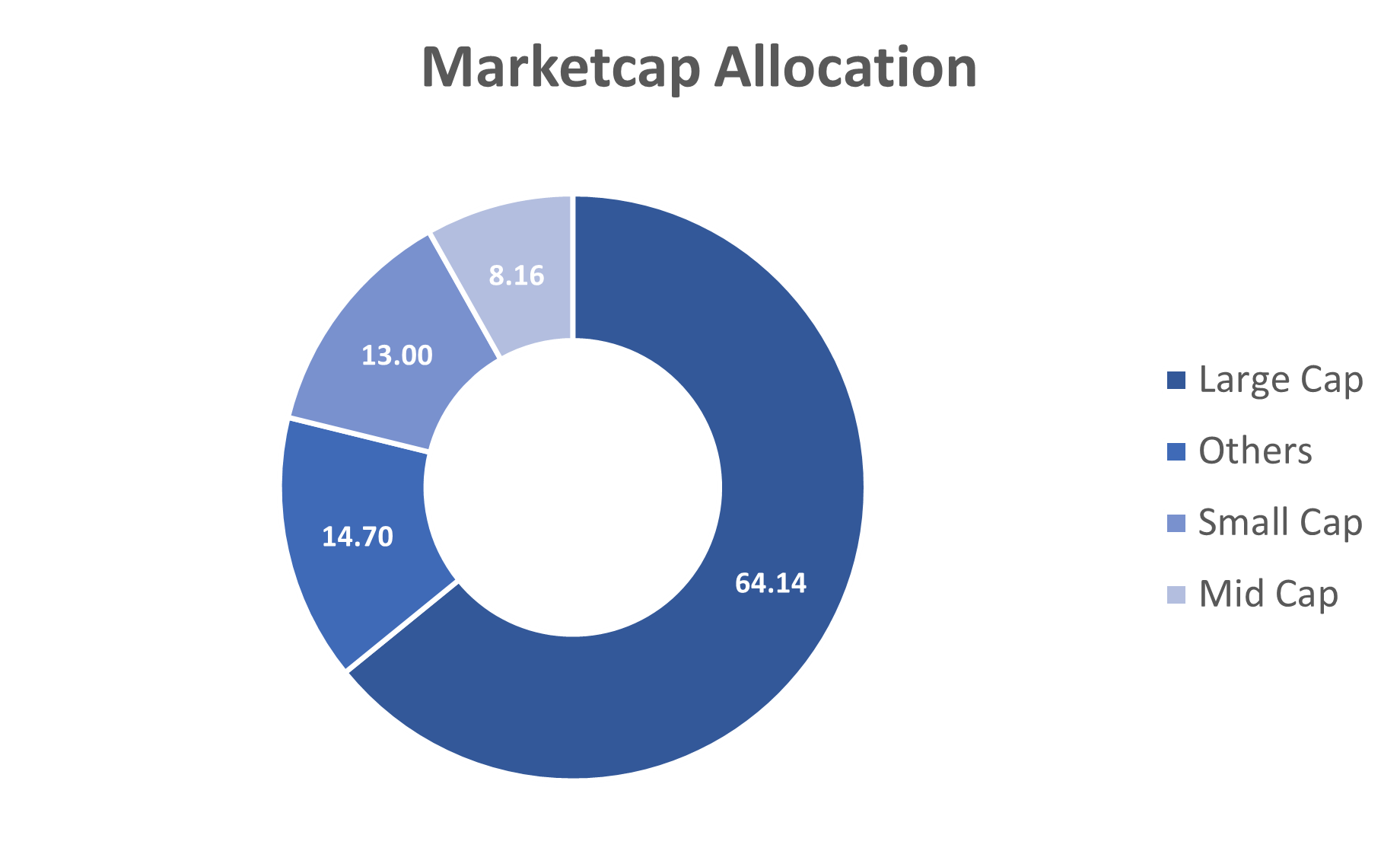

Embark on a journey of unprecedented wealth growth with Wealth Maximizer, a strategic investment vehicle designed to provide long-term capital appreciation for discerning investors. Our fund takes inspiration from the successful principles of Value Investing, and Our primary objective is to provide investors with the opportunity to maximize their wealth through a concentrated portfolio of Indian equities.

Key Features of Wealth Maximizer:

Long-Term Capital Appreciation

At the core of Wealth Maximizer is the commitment to long-term capital appreciation. We meticulously select a portfolio of Indian equities with the potential to deliver sustained growth over an extended period, ensuring that your wealth continues to prosper over time.

Momentum-Based Approach

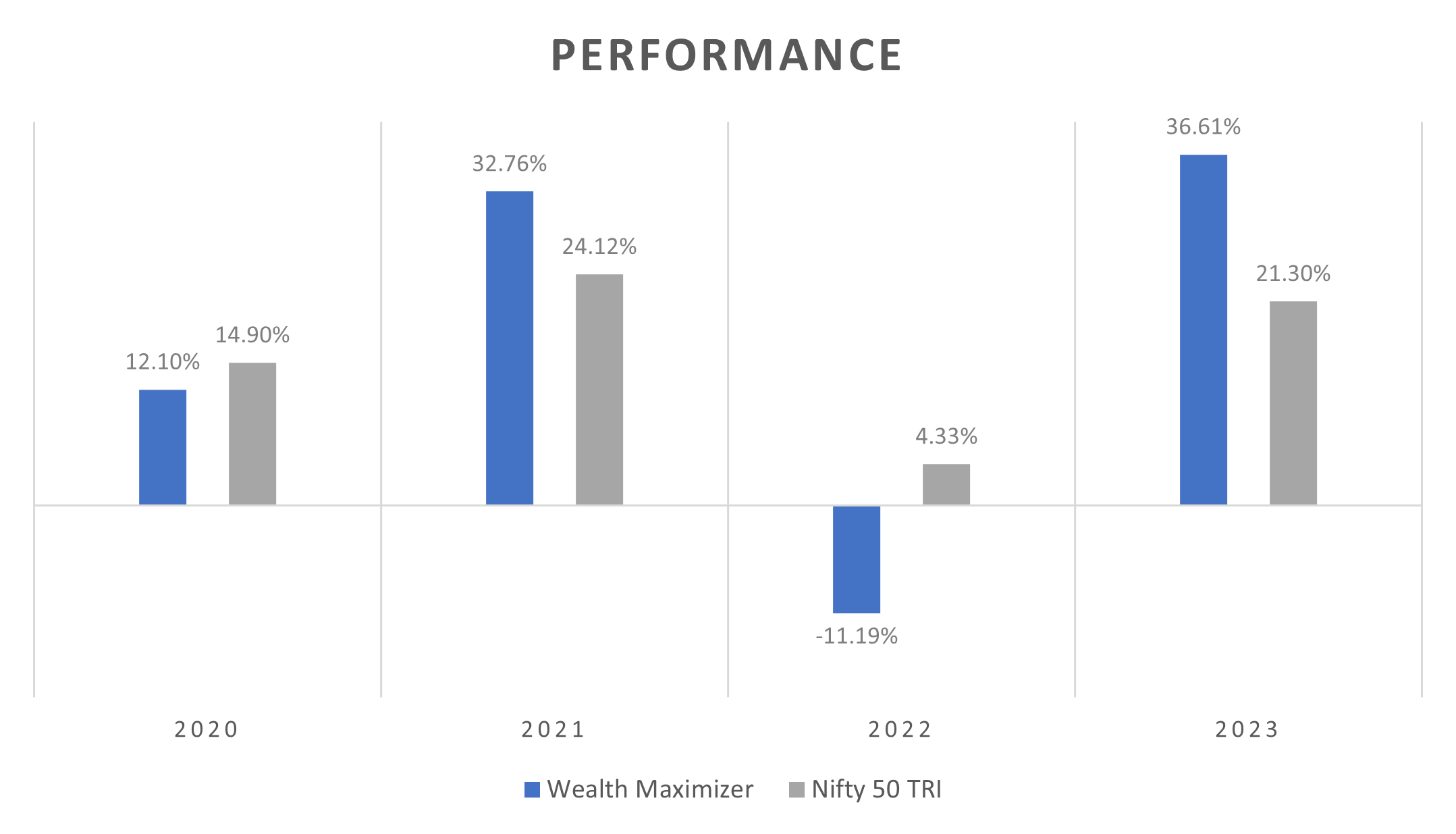

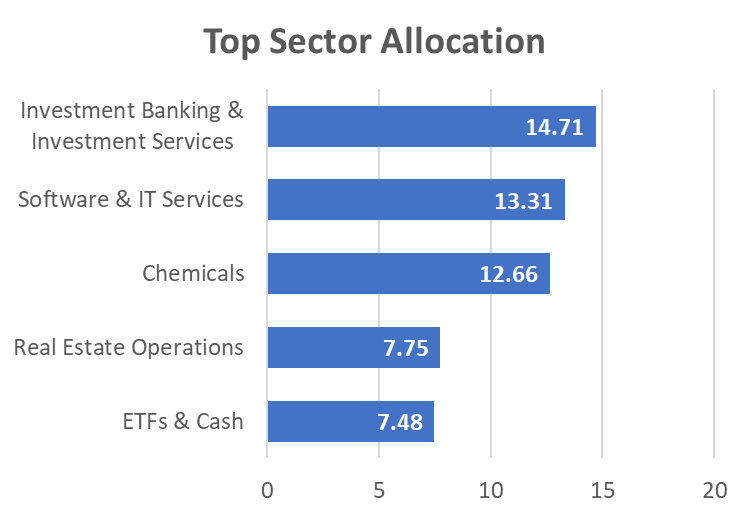

Our investment strategy is grounded in a disciplined, concentrated momentum-based approach. MRG Capital capitalizes on market anomalies and meticulously chosen investment opportunities, leveraging the power of momentum to consistently outperform benchmarks.

Consistent Outperformance

Wealth Maximizer seeks to consistently outperform benchmarks. Through thorough research and strategic decision-making, we aim to stay ahead of market trends, providing investors with the opportunity to realize returns that surpass industry standards.

Robust Growth Trajectory

While prioritizing long-term capital appreciation, Wealth Maximizer is dedicated to creating a robust growth trajectory for your investments. We identify and invest in assets with the potential for substantial growth, aligning your portfolio with the dynamics of a rapidly evolving market.

Risk Management

We understand the importance of safeguarding your capital. Our approach integrates robust risk management strategies to navigate various market scenarios. This ensures that your investments are resilient, delivering stable returns even in the face of market fluctuations.

Fund Information:

- Inception Date: 17th May 2019

- Category: Equity Diversified

- Type: Open Ended

- Benchmark: NIFTY 50 TRI

- Minimum Investment Amount: Rs 50 L

- Investment Horizon: 5 – 7 Years

- Fund Manager: Mr Manu Rishi Guptha