Is a Financial Tsunami Building up?

Just as the stock price of Tesla kisses $2000 (and by the time i finish writing this piece, it might be $2200) and Apple is way past the 2Tr$ Marcap, I receive a text message from an enthusiastic friend of mine who first started investing a few months ago (March 2020) after being forced to work from home and shared his stellar success at his new-go at the markets. He shared his desire to be a professional fund manager and started exploring ways to get a SEBI license to be a RIA (Investment Advisor) or a Portfolio Manager.

Covid has been the most unfathomable disruption, the likes of which hasn’t been seen by anyone alive today. The concept of Black Swan stands redefined which – till now – was an unexpected and improbable event and people would often relate to it by comparing it with a Tsunami or an accident or a sudden unexpected failure of an enterprise with global ramifications.

No one had ever imagined that within days, the global borders would be closed, airlines across the planet would be grounded (95% still remain grounded as I write this), and all levers of the global economy (travel, trade, manufacturing, shipping) would come to a grinding halt. ‘Sudden Stop’ in global economy was an academic expression that became a reality almost instantly.

Some 30 million Americans lost their jobs (more than 3 times than the previous highest), markets crashed by about 40% in 3-4 trading sessions, China got blamed for its alleged Chinese Virus, oil hit (-) 37 $ while the global leaders remained clueless and the only policy response was a complete lockdown of nations as leaders grappled with the enormity of the situation.

Some 30 million Americans lost their jobs (more than 3 times than the previous highest), markets crashed by about 40% in 3-4 trading sessions, China got blamed for its alleged Chinese Virus, oil hit (-) 37 $ while the global leaders remained clueless and the only policy response was a complete lockdown of nations as leaders grappled with the enormity of the situation.

Hundreds of millions of people have lost their jobs and millions of small businesses have shut down forever and the economic contraction has been so secular that some of the most high flying businessmen and executives have resigned themselves to the new normal only yearning for their basic needs to be met for their families and themselves.

While some countries have shared the real data and the extent of severe and unprecedented economic contraction, most have conveniently chosen not to release the same either to avoid embarrassment or to avoid panic. But imagine, for a second, that everything (revenue, earnings, profit, salaries, rentals, commoditiesetc etc etc) gets deflated by 40-70% – what effect it is likely to have on the global economy.

If the savings rate from income varies from 1% to 25% in different parts of the globe (it is believed that more than 70% Americans have less than $500 in savings and the max savings rate is about 25% in China and India), it is safe to assume that every person on a monthly salary / entrepreneur is already digging into life investments and assets to keep afloat as the inflow (after salary cuts or loss of income) is far lesser than the outflow. Majority of my friends and acquaintances have either stopped their SIPs or redeemed their Mutual Funds. I read that last 2 months have been the worst for the MF industry because of incessant redemptions and negligible inflows.

And Yet…

The Indian and global stock markets have shown immense resilience making these an easy ATM to churn out daily profits for Robinhooders.

Human memory is short and 10 years is a long time to lose and gain confidence all over again and the stars (Corporations and Executives) of yesteryears fade away while the new ones emerge on the evolutionary principles of Creation – Preservation and Destruction

It is believed statistically that 95% of market participants and fund managers have less than 12 years of experience which implies that only 5% have seen the crash of 1987, 2000, 2008 and a few other mentionable flutters in between. And human mind is generally tuned to be optimistic as hope and evolution trains the mind to expect a better future always in every which way. Little credence is given to people who invoke caution and sometimes border pessimism as a result of lifelong experiences and perhaps that’s the reason the world is deriding WarrenBuffett for having lost a decade by underperforming and not investing in Tesla and Amazon and all the 30 yr olds have seemingly outperformed by simply investing in Tesla or Kodak or Overstock kind of shares.

Parameters such as performance Ratios, Profits, Real cash in the hands of shareholders have lost every mentionable significance and price earnings of 200/300 or even 1000 in case of Tesla seems like ‘THE’ new normal.

And while the bears have been irreparably scathed in this recent melt-up, it would be prudent to remember that over long periods of time, either the price catches up with the fundamentals of a stock or the fundamentals catch up with the price, but just to put the things in perspective (and I know nothing about Tesla and am not a Tesla basher sitting here in India – but it’s a good example) if Tesla was to maintain its present earnings, it would take about 1000 years to fully recover ones investment through Tesla s present earnings. Anyone who buys a Tesla stock now is valuing it at approx. a million dollars for every car sold.

Markets are a beautiful place that allow immense wealth to be created and accumulated for people who have patience and discipline but history is replete with examples of more than 70% of investors of all times to have permanently lost capital by chasing garbage (aka penny stocks) that seems to provide short term euphoria.

Lets talk of a few Indian stocks and themes or should I say wealth destroyers.

Between 2003 and 2008 Infra and Housing was a great story and a mere ‘infratech’ (use of tech and infra) in a company s name would get it rerated. Unitech, IVRCL, HCC, NCC, Sintex, DLF, …………… have destroyed almost 99% of shareholder wealth and most of these names have got delisted leading to permanent destruction of wealth. During hay days these were stocks that were the market darlings

Then came the era of banking and finance. Between 2009 and 2018 NBFC s and Banks had a dream run before the euphoria and invincibility of the sector was popped by the ILFS, Yes and DHFL type of fiascos and recently while a top outgoing CEO dumped his entire shareholding and ESOPS of 26 years in a jiffy (perhaps to pay for the expenses of grocery, maids and electricity bills during tough times amidst the pandemic), the gullible public and minority shareholders will be the last to keep holding the hot potatoes and the music would stop suddenly.

And Now

We have the API and the pharma theme on an assumption that all the medicine factories on this planet will stop production and all pharma orders will come rushing to Indian companies and the world population might start eating medicines instead of fruits and vegetables all produced by Indian pharma companies.

The same story gets repeated again and again. While the robinhooders are gloating in the wealth created by some new age, recently discovered pharma companies doubling in the value in less then 2-3 months, the end is always painful when the music or the party stops. And by the way graphite was the pharma of today or pharma/API was the graphite of those times.

The 5% people who have been around, all of them understand this, having gone thru cycles, but the 95% neither have the wherewithal or the research to truly fathom the depth or the lack of it in the present euphoria.

Every crop must be harvested at a specific and optimum time, lest it should rot. Same goes for ones stocks, corporations, businesses. Buying or creating is natural to ones instinct of evolution, letting go / harvesting is an art which very few understand or develop. And most end up in a feeling of regret esp small and minority retail investors who fall in love with their stocks, cannot sell and take the profits home.

The trouble is that most fund managers are obliged to be eternally optimistic (ignoring the risks) else they would face redemption thereby leading to lesser fees for the fund-house. Very few investors realize that cash in itself is a strategy and a position worth considering and to be in from time to time.

As Howard Marks says “To be a disciplined investor you have to be willing to stand by and watch other people make money on things that you passed on”.

Irony of the markets is well evidenced, rather strongly in just this one case in point :- PVR Cinemas

PVR used to be a perfectly fine and a successful popcorn and coke reseller till the pandemic struck and just 11 days of disruption in March saw its profit fall thru the floor. The future is bleak with zero sale in first 2 quarters and any of the movie buffs whom I have spoken to in Delhi, Bangalore and Bombay (where PVR has max screens) are not going back to a cinema hall as people have found a new freedom on OTT platforms and using affordable projectors at home and replicating a cinema hall effect without risking oneself to the virus-exposure.

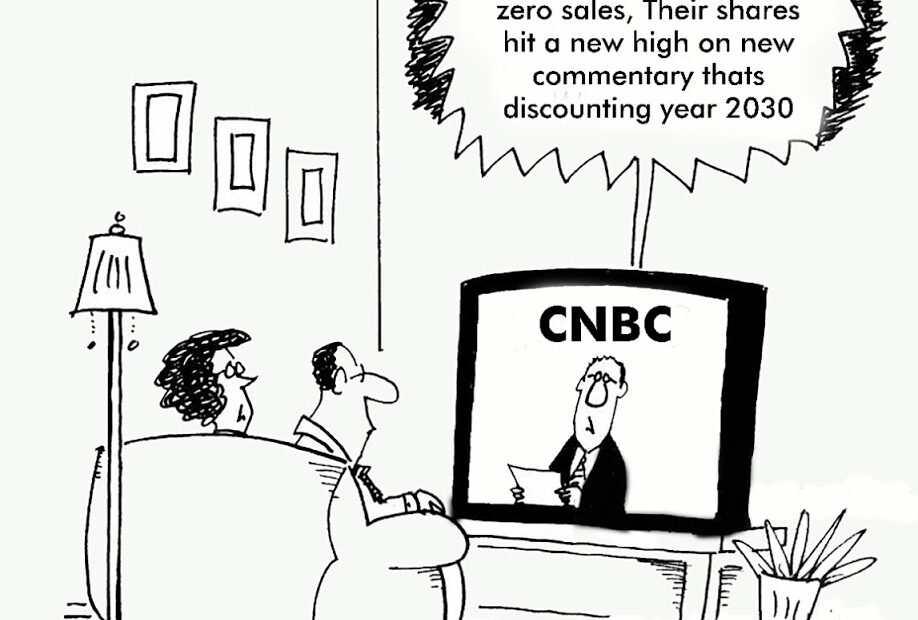

Producers are preferring – selling to and releasing movies through OTT platforms as that reduces their risk to zero. And yet retail investors are finding virtue in this company that has zero sales, bleak future, debt ridden and trading at 300 times its trailing earnings and no visibility of the future earnings. Some PVR stock lovers say – all will be well in a few years, we are looking at 2030.

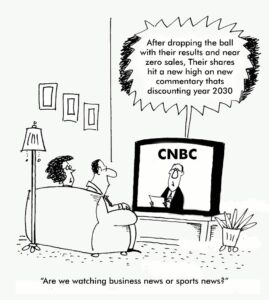

CNBC has single headedly taken it upon itself to create a euphoric environment shrouded by global liquidity and has allowed all dubious promoters to talk up their stocks only on the base of ‘positive commentary’ as if the alchemist in them can turn just commentary into profits, cash and dividends.

On the other had a company like ITC that produces more cash and profits than all the other 6-7 top FMCG companies, is debt free, is trading at abysmally low valuations (15 times trailing earnings) and yet the robinhooders find it less appealing.

This dichotomy will self correct sooner rather than later and will come with its own collateral damage which most new entrants in the markets aren’t ready to handle.

Harvest Your crop, take profits off the table, let some notional profits be lost along the way but evaluate the risk and reward that any company, valuation, story, potential – offers.

If this fine art of valuation equilibrium can be discovered, small investors would do themselves a great service of increasing their longevity in the markets and protecting their capital.

Enjoy the party, stay close to the door, so when the stampede starts, You can safely escape without being trampled.

My twitter handle @manurishiguptha

www.manurishiguptha.com

As always, great article Manu – Would you recommend moving out of stocks at this time?

Well said 👌. As of now, no takers for this view. I am in your group of thinking. Let's hope this time it's different.

Aptly worded .

crucial period to cross through.

With the current liquidity boost by all major central banks, the concepts of P/E, RoCE, RoE need to be reevaluated.

If my cost of capital is, say 1%, then I would not mind paying for high P/E or low RoE stocks.

Hence, I believe that the old formula of P/E less than 20 is good and above 30 is expensive may need to be recalibrated. Going forward, as long as easy money remains, 30 may become the new 20.

Not able to understand the concept of harvest and take the profit out of the table..this is okay incase of short term trading stocks…I have position in ITC, Altria and BAT….all are extremely undervalued and have bought for lifetime as of now…are you recommending to sell after a normal profit in these stocks or hold till the business changes its fundamentals…pls

What are you exactly suggesting? Should we sell all our portfolio holdings and wait for the right time to re-enter?

But the same wisdom a few days ago could have worked in recently concluded AGM. Now AGM is at least 11 months away and by that time every body including rishi Gupta will forget.